www.utsclaims.com Since 2003 14419 Greenwood Ave. N. Suite A-374, Seattle WA 98133 Email: support@utsclaims.com

I AM,

THERE-

FORE

I THINK!

THERE-

FORE

I THINK!

I WISH MAN WOULD STOP BLAMING ME FOR HIS EVIL DEEDS. NEED I REMIND YOU, IT IS GOD WHO SAID HE CREATES EVIL, NOT ME! SO IF YOU WANT TO BLAME SOMEONE. BLAME HIM! ISAIAH 45:7

IDIDN'T ASK TO BE

BLACK

I JUST GOT LUCKY

BLACK

I JUST GOT LUCKY

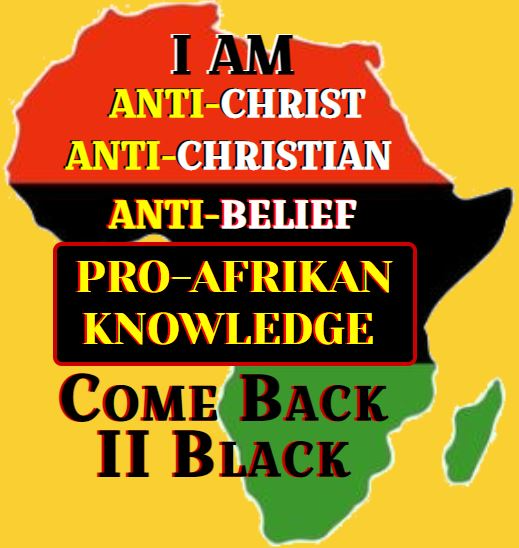

PRO-AFRIKAN KNOWLEDGE

ANTI-CHRIST

I AM

ANTI-CHRISTIAN

ANTI-BELIEF

COME BACK

II BLACK

II BLACK

I AM

FIGTHING TERRORISM

OF AFRICAN AMERICANS

OF AFRICAN AMERICANS

SINCE OCTOBER

23RD, 4004 B.C.E.

23RD, 4004 B.C.E.

YOU VISIT FLORIDA ON VACATION

YOU LEAVE FLORIDA ON PROBATION