They Stole Our Ancestors & Made Us Slaves

They Stole Our Land & Gave Us the Bible

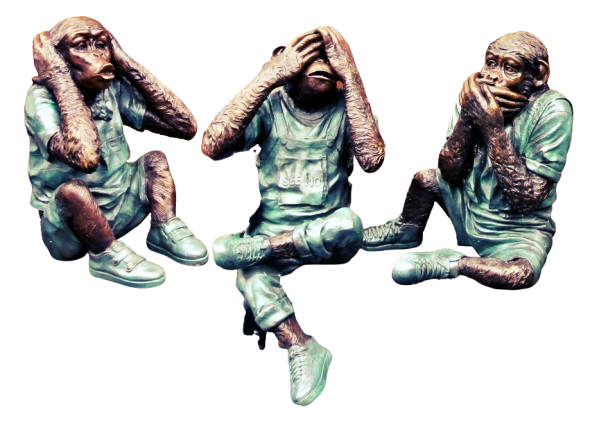

They Hid Our History & told Us we have none

They Stole Our Land & Gave Us the Bible

They Hid Our History & told Us we have none

NKT DONATE $5.00 TO WIN!

Double click here to edit this text.

"THE GLUE THAT BINDS"

IF YOU'RE READING THIS SHIRT, I AM THE TRIGGER OF YOUR NEXT THOUGHT. NOW GIVE THAT THOUGHT SOME THOUGHT!

G

O

R

I

L

L

A

O

R

I

L

L

A

G

A

N

G

U

N

I

T

A

N

G

U

N

I

T