1.800.225.1965

WE ARE BORN IN

A BOX

A BOX

WE LIVE IN

A BOX

A BOX

BURIED IN

A BOX

A BOX

YOU THINK IN

THE BOX

THE BOX

RELIGION - FILTERED AND CLOUDY

YOUR LIGHT IS NOT YOUR OWN

SEEKS OUTSIDE THE SELF

YOUR CANDLE BURNS FROM THE LIGHT OF ANOTHER

THE LIGHT IS NOT YOURS BUT SHARED AND FILTERED

A CANDLE LIT BY ANOTHER CAN BE BLOWN OUT

YOUR LIGHT IS NOT YOUR OWN

SEEKS OUTSIDE THE SELF

YOUR CANDLE BURNS FROM THE LIGHT OF ANOTHER

THE LIGHT IS NOT YOURS BUT SHARED AND FILTERED

A CANDLE LIT BY ANOTHER CAN BE BLOWN OUT

SPIRITUALITY - PURE AND UNFILTERED

YOU ARE A LIGHT UNTO YOURSELF

MUST SEEK WITHIN THE SELF

YOUR CANDLE BURNS FROM YOUR LIGHT WITHIN

YOUR LIGHT IS PURE AND NOT FILTERED

YOUR LIGHT CANNOT BE BLOWN OUT BY ANOTHER

YOU ARE A LIGHT UNTO YOURSELF

MUST SEEK WITHIN THE SELF

YOUR CANDLE BURNS FROM YOUR LIGHT WITHIN

YOUR LIGHT IS PURE AND NOT FILTERED

YOUR LIGHT CANNOT BE BLOWN OUT BY ANOTHER

RELIGION

- CONDITIONAL LOVE

- DIVIDES HUMANITY

- PASSES JUDGEMENT

- SELFISH BELIEFS

- SEEKS OUT A SAVIOR

- DIVIDES HUMANITY

- PASSES JUDGEMENT

- SELFISH BELIEFS

- SEEKS OUT A SAVIOR

- UNCONDITIONAL LOVE

- ONE HUMAN FAMILY

- WITHOUT JUDGEMENT

- SELFLESS AWARENESS

- SEEKS FROM WITHIN

- ONE HUMAN FAMILY

- WITHOUT JUDGEMENT

- SELFLESS AWARENESS

- SEEKS FROM WITHIN

TIMEOFFZERO

HOW MUCH DID THE BIBLICAL ADAM & EVE CREATION STORY CHANGE IN A SPAN OF 1,350 YEARS REMOVED?

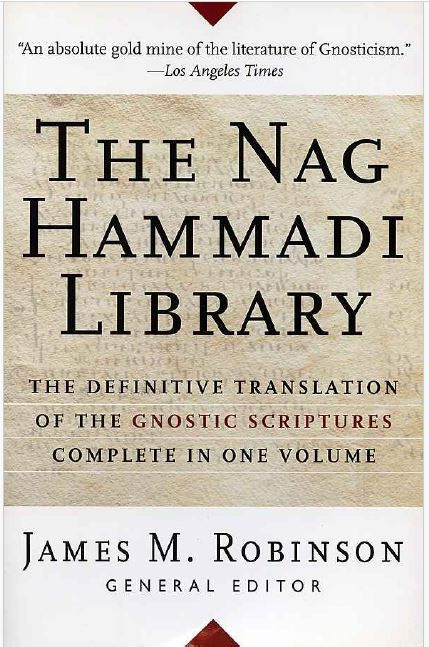

THE FIRST: THE 250 A.D. CHRISTIAN / HEBREW NAG HAMMADI SCRIPTURES

VS

THE LAST: THE 1611 A.D. CHRISTIAN KING JAMES AUTHORIZED VERSION

SPIRITUALITY

Double click here to edit this text.

$5.00 GIFTS

BASKET

BASKET

YOU WORK IN A BOX